In the midst of geopolitical tensions, economic uncertainty, and ongoing inflation, numerous consumers feel uneasy about their financial situation.

For certain individuals, gold — known for its status as a safe-haven investment — may offer a potential solution.

Are you worried about the impact of looming economic or geopolitical issues on your wealth? Discover how investing in gold in 2024 can provide a solution.

Is investing gold a good idea In 2024?

Here are several reasons why you might want to consider investing in gold this year:

Minimize risk by diversifying your portfolio

Relying solely on one investment avenue is very risky. For instance, if you’re heavily invested in the stock market and the S&P 500 experiences a downturn, you stand to lose a lot of money. Similarly, if you have substantial investments in real estate and another bubble bursts.

Incorporating gold into your portfolio — an asset known for its inverse relationship to many other investment types — Adding gold to your portfolio helps balance out risk and safeguard your wealth.

“Americans are looking for stability, and many are turning to precious metals like gold and silver” says Bill O’Reilly.

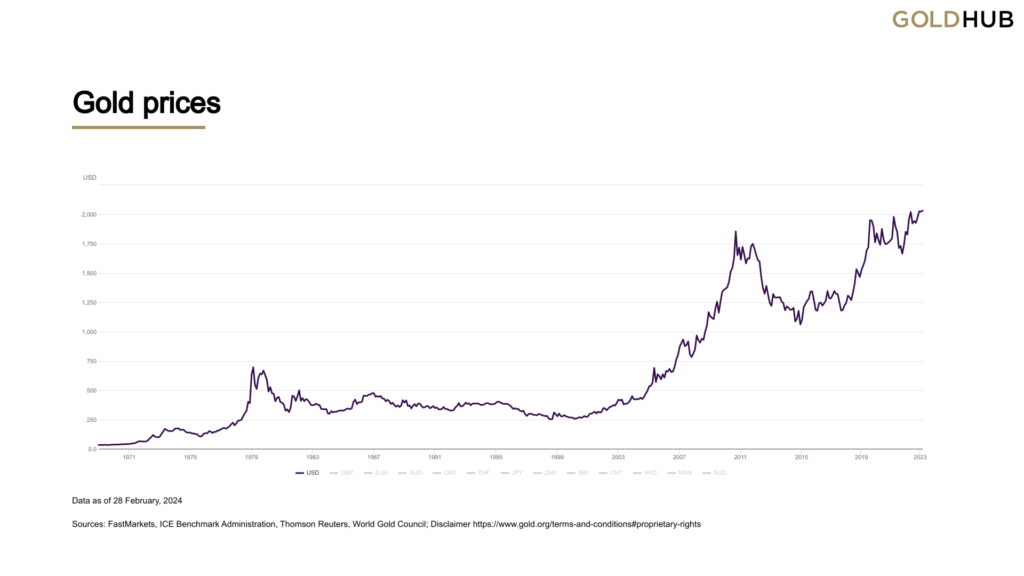

On August 28, 2008, the S&P 500 fell 48% in a little over 6 months to its low on March 9, 2009, according to the Federal Reserve Bank of Atlanta. However, the price of gold increased by approximately 14.81% from August 2008 to March 2009, according to data from the World Gold Council. Also, a similar event happened between 1976-1978. At that time, S&P dropped over 19%, while gold went up nearly 54%.

It serves as a safeguard against ongoing inflation

Gold is widely recognized as an effective hedge against inflation, enabling you to safeguard wealth — even as paper currency depreciates in purchasing power. Its scarcity prevents it from being devalued by oversupply, unlike the dollar, which can be subject to depreciation.

Although inflation has slightly decreased since the Federal Reserve began raising interest rates earlier last year, it remains at 3.7% — significantly surpassing the Fed’s 2% target.

It serves as a safe haven to shield against market uncertainty

During geopolitical conflicts, instability often occurs, prompting investors and consumers to seek refuge — a place where their money can be safeguarded and retain its value despite political upheavals. As a scarce asset, gold provides a safe haven.

As evidence, consider recent gold price movements following the onset of the Israel-Palestine conflict in early October. Beginning October 8 — the day after the initial attack — gold prices surged from $1,809 to $1,983 per ounce, indicating a 5% increase in just a few weeks.

It maintains your liquidity

Lastly, gold is an investment that ensures liquidity. It remains in demand, allowing you to buy or sell it whenever necessary. This liquidity can be beneficial in case of unexpected expenses, job loss, or other financial hardships, serving as a valuable safety net during uncertain economic conditions.

How you can invest in gold in 2024

There are a number of ways to acquire gold. You can buy physical bars or bullion, start a gold IRA, or invest in gold ETFs, among other approaches. Depending on your risk tolerance, you can also buy gold mining stocks or futures.

If you choose physical gold, remember: Purchasing larger quantities or opting for bars instead of coins might lower your price per ounce. Therefore, it’s essential to explore various options before proceeding. Additionally, consider the expenses associated with transporting, storing, and insuring your investment.