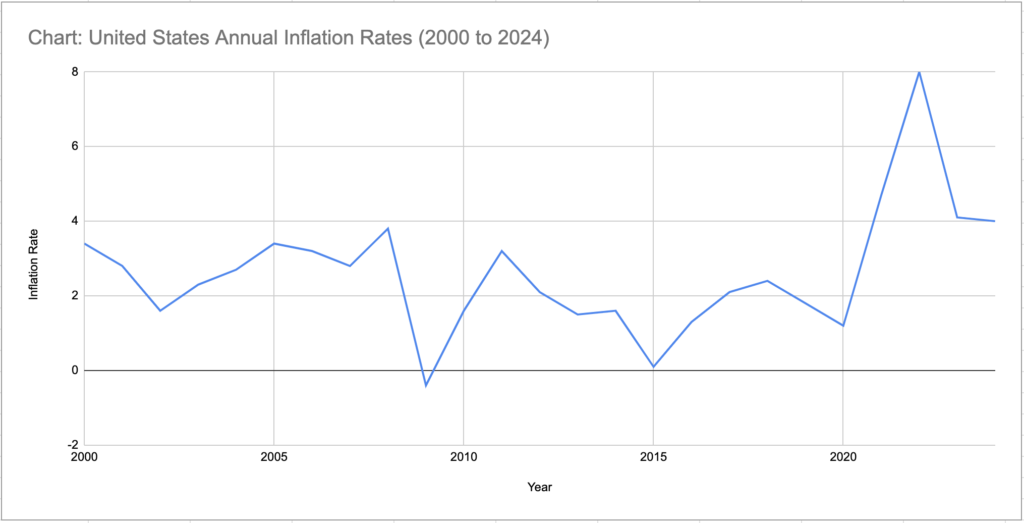

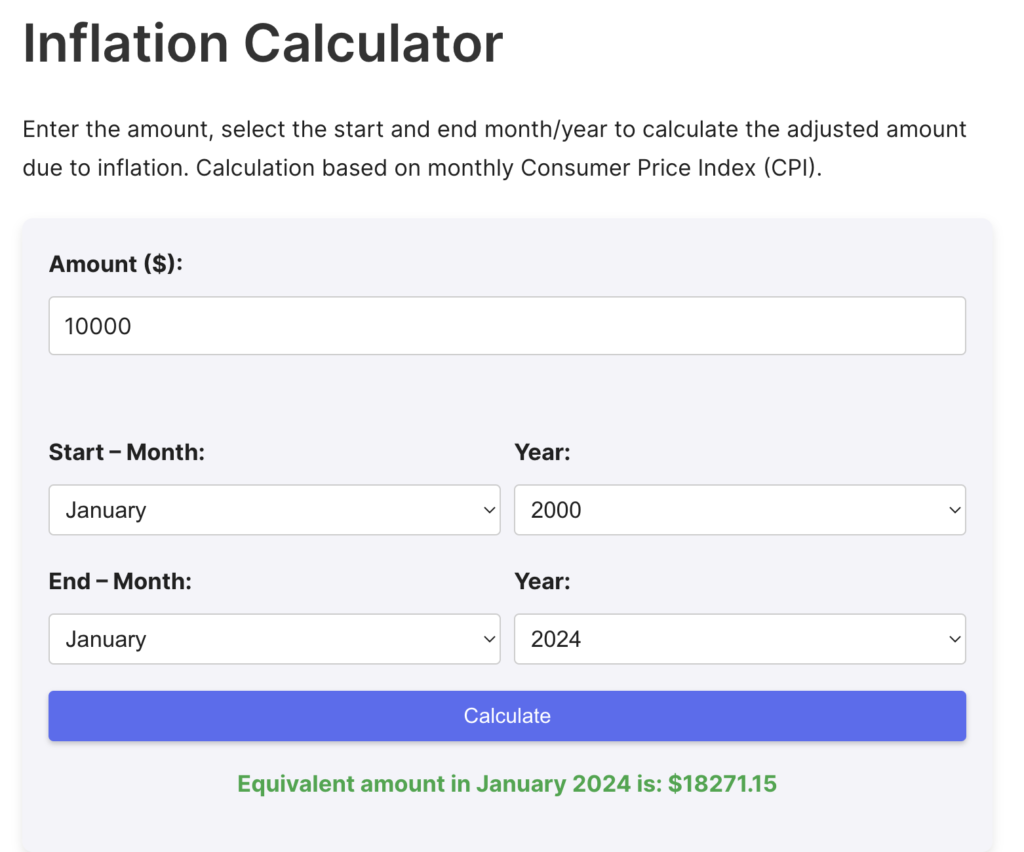

Since the year 2000, inflation has played a significant role in the U.S. economy, affecting the purchasing power of consumers. For example, the equivalent purchasing power of $10,000 in January 2000 has increased to $18,271.15 by January 2024 due to inflation. This shift underscores the diminishing value of money over time and highlights the importance of strategic financial planning.

Current Inflation Trends

As of March 2024, the U.S. annual inflation rate is reported at 3.5% (InflationData). This figure represents a moderate increase in consumer prices, which can substantially influence economic sentiment and purchasing behavior. Historical data shows that inflation rates have seen significant fluctuations, such as the sharp rise to around 9% in 2022, demonstrating the unpredictable nature of inflation. Moreover, these inflationary pressures have contributed to a drop in U.S. consumer sentiment, which reached a six-month low due to concerns over inflation and unemployment as reported by AP News. For a detailed look at monthly inflation rates throughout 2024, refer to the comprehensive report by Statista on U.S. monthly inflation rate 2024.

Why Consider a Gold IRA?

Hedging Against Inflation with Gold

Investing in a gold Individual Retirement Account (IRA) is a proven strategy to protect against inflation. Gold is often viewed as a safe haven in times of economic uncertainty, with its value generally increasing in response to rising inflation. This makes gold IRAs an attractive option for those looking to preserve their wealth.

Choosing the Right Gold IRA Provider

It’s crucial to select a reliable gold IRA provider to ensure that your investment is secure and profitable. Reviewing different companies can help you find the best service that fits your investment goals. A detailed comparison of top gold IRA companies is available for investors looking to make informed decisions.

Tools for Calculating Inflation Impact

The Role of an Inflation Calculator

To fully understand how inflation affects investments, an inflation calculator is an indispensable tool. This calculator, found at Best Gold Investments Inflation Calculator, is based on the monthly Consumer Price Index (CPI) data starting from 1913. By inputting different values and time frames, you can see how much your money would be worth in different inflation scenarios. This tool is particularly useful for planning long-term investments and retirement savings.

Where to Find the Best Inflation Calculator

For accurate and user-friendly inflation calculations, visiting Best Gold Investments can provide the insights needed to make informed financial decisions. This website offers a comprehensive calculator that adjusts for various inflation rates over time, helping you visualize the potential future value of your money.

In Conclusion

With the ongoing fluctuations in inflation and its potential increase in the coming years, individuals are advised to consider robust investment strategies like gold IRAs. Tools such as an inflation calculator also play a critical role in financial planning, offering valuable insights into the impact of inflation on investments. Visit our best gold IRA companies and use our inflation calculator for more information.