In this review, we’ll take a closer look at Augusta Precious Metals, a company specializing in gold IRA (Individual Retirement Accounts). If you’re considering investing in gold for your retirement, it’s essential to choose a reputable company. Augusta Precious Metals has gained attention in the industry, but let’s dig deeper to see if they live up to the hype.

Augusta Precious Metals is a company that offers gold IRA services, allowing individuals to invest in gold as part of their retirement savings strategy.

Augusta Precious Metals Review

Ensuring your retirement strategy is robust means diversifying your investment portfolio. Introducing precious metals like gold and silver can act as a shield against inflation and market swings.

Are you contemplating the inclusion of gold and silver in your retirement savings plan? Augusta Precious Metals stands out as one of the best gold IRA companies, aiding countless investors in broadening their portfolios with tangible gold and silver assets.

Is Augusta Precious Metals the perfect match for your investment objectives? In this review of Augusta Precious Metals, we’ll delve into customer feedback, advantages and disadvantages, fee structures, storage options, promotions, and more.

Here’s what we’ll cover in this review:

- Augusta Precious Metals Overview

- Is Augusta Precious Metals legit?

- What services does Augusta Precious Metals provide?

- What is the minimum investment at Augusta Precious Metals?

- What makes Augusta precious metals unique?

- What are the pros and cons of investing with Augusta Precious Metals?

- In Conclusion

Augusta Precious Metals Overview

Established in 2012 by CEO Isaac Nuriani, Augusta Precious Metals has risen as a top dealer in precious metals. Specializing in gold and silver IRAs, the company facilitates investments in physical precious metals for retirement purposes. Based in Casper, Wyoming, Augusta Precious Metals boasts an A+ rating from the Better Business Bureau with no complaints filed, solidifying its position as a leading player in the gold IRA market over the past eleven years.

Notably endorsed by renowned figures such as quarterback Joe Montana, Augusta distinguishes itself through its commitment to education and exceptional customer service. With a team of knowledgeable IRA and coin educators, Augusta equips investors with valuable resources to make informed decisions regarding precious metals investments.

One of the key advantages of setting up a gold IRA through Augusta Precious Metals is the additional protection and security offered by owning physical assets. Gold’s enduring status as a safe haven for wealth makes it an appealing option for investors seeking to safeguard their retirement savings.

Is Augusta Precious Metals legit?

Augusta Precious Metals has built a solid reputation in the precious metals industry. With years of experience and positive customer reviews, they have established themselves as a trusted provider of gold IRAs.

What services does Augusta Precious Metals provide?

The company offers a range of services to help individuals invest in gold for their retirement. This includes assistance with setting up a gold IRA account, purchasing gold bullion and coins, and ongoing support to help clients manage their investments.

In addition to their gold IRA investment options, Augusta provides the opportunity to directly purchase gold and silver bars as well as coins.

Gold and Silver IRA

At the heart of Augusta Precious Metals are self-directed gold and silver Individual Retirement Accounts (IRAs). These IRAs function similarly to traditional ones, but instead of paper assets, they involve physical gold and silver holdings. They offer the same tax advantages while serving as a hedge against inflation. Augusta offers a diverse selection of IRS-approved gold and silver coins and bars for IRAs, including:

Gold coins and bars available for IRA purchase:

- American Eagles

- American Eagle Proofs

- Canadian Maple Leaf

- Gold Canadian Eagle

- American Buffalo

- Australian Striped Marlin

- Gold bars: 10 oz, 1 oz

Silver coins and bars available for IRA purchase:

- Canadian Silver Soaring Eagle

- Canadian Silver Eagle with Nest

- American Silver Eagle

- Canadian Silver Maple Leaf Silver bars: 10 oz, 100 oz

Their team assists in facilitating fund rollovers from existing IRAs or 401(k) accounts and provides guidance in selecting metals for the IRA.

Gold and Silver Direct Purchases

If you’re not keen on investing in an IRA or if you fall short of the $50,000 minimum investment requirement, Augusta Precious Metals still offers you the option to directly purchase gold and silver products. The company provides coins and bars for sale outside of an IRA, and they can deliver these products to your preferred location at no additional cost.

Bullion Offerings

Augusta Precious Metals presents a variety of commonly sought-after gold and silver bullion products, all conveniently accessible through their website. However, prices are not listed online and need to be confirmed directly with Augusta Precious Metals at the time of purchase. According to their transaction agreement, Augusta Precious Metals may sell common bullion products with a margin of up to 5.2%. Once your order is confirmed, the price will be locked in.

Storage and Delivery

Augusta partners with trusted third-party depositories nationwide to store your bullion for IRA accounts. Although Delaware Depository is their preferred choice, you have the freedom to select another nearby facility if desired. For cash purchases, you can either store your items in these depositories or have them shipped directly to your home. However, it’s crucial to acknowledge the potential risks linked with home storage, and Augusta can offer guidance on this matter.

What is the minimum investment at Augusta Precious Metals?

Despite their streamlined process and reliable customer support, it’s essential to grasp Augusta Precious Metals’ fee structure before diving into investments.

Investment Minimum: Augusta Precious Metals sets a high bar with a minimum investment requirement of $50,000.

How much does Augusta Precious Metals charge for IRA?

Understanding fees is crucial for making informed investment choices. Augusta Precious Metals simplifies this process by providing a transparent IRA fee structure, which comprises a one-time setup fee, annual custodianship fees, and storage fees for your metals. Here’s an overview of Augusta Precious Metals’ account fees:

One-Time Setup Fee: $50 (Augusta will cover)

Annual Maintenance Fee: $80 (reimbursed by Augusta)

Annual Fees:

Custodian Fee: $100 (reimbursed by Augusta)

Storage Fee: $100 (reimbursed by Augusta)

Storage Fees:

Non-segregated storage: $100

Segregated storage: $150

Augusta’s fees are in line with other gold IRA companies, and their customer service is highly praised. They openly disclose all fees upfront, ensuring no hidden costs. Additionally, Augusta applies a markup to the base price of precious metals, which varies by product but remains competitive within the market. For precise pricing details, it’s advisable to contact an Augusta representative, as gold and silver market rates fluctuate daily. Importantly, Augusta offers fee reimbursements for accounts surpassing $50,000 for eligible purchases, potentially leading to long-term savings. Remember, conducting thorough research and comparing different providers is essential before making any investment decisions.

What makes Augusta precious metals unique?

Augusta Precious Metals garners high ratings for its outstanding customer service, steadfast dedication to education, and transparent pricing. These qualities have positioned them as a preferred option for numerous individuals seeking to establish a precious metal IRA.

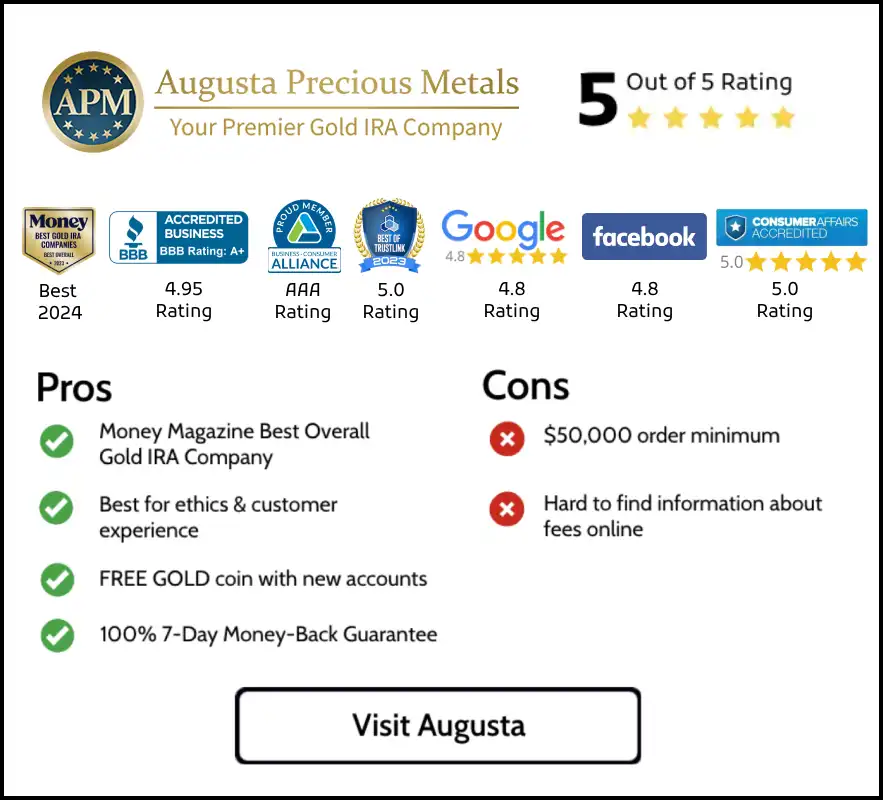

What are the pros and cons of investing with Augusta Precious Metals?

Let’s review the pros and cons of Augusta Precious Metals gold IRA:

Pros

- Best for ethics & customer experience

- A+ BBB rating and AAA at BCA

- No complaints filed from customers

- Money Magazine “Best Overall” Gold IRA Company

- Investopedia: “Most Transparent Pricing”

- FREE GOLD coin with new accounts

- ZERO setup fees up to 10 years

- Highest Buyback Guarantee

- 100% 7-Day Money-Back Guarantee

- YOU choose your gold & silver

- Account lifetime service

Cons

- $50,000 order minimum

- Hard to find information about fees online

In Conclusion

We trust this Augusta Precious Metals review has been informative and beneficial. Gold IRAs offer investors a path to portfolio diversification through precious metals. Augusta Precious Metals, recognized by Money magazine for its educational resources and customer support, stands as a top choice among gold IRA companies.

Overall, Augusta Precious Metals offers a reputable and reliable option for individuals looking to invest in gold for their retirement. With a solid reputation, comprehensive services, excellent customer support, and transparency, they have earned their place as a top choice in the gold IRA industry. If you’re considering investing in gold, Augusta Precious Metals is worth exploring further.